Key takeaways

AGBLECOM PARTNERS is an innovative company providing a new insight into Togo’s economic growth and new ways of doing business in the private sector. It aims at helping investors, C-Suit executives, regulators, state officials and entrepreneurs make informed decisions.

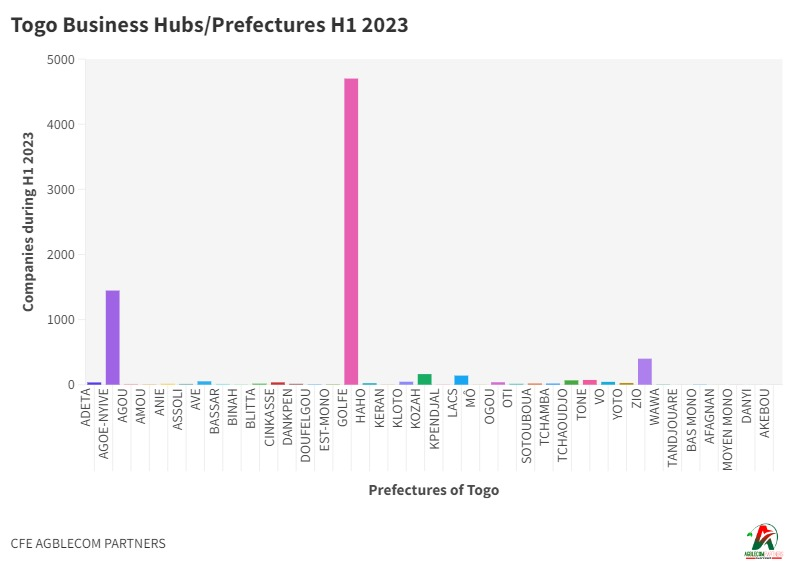

AGBELCOM PARTNERS is introducing the Togo Prefecture Ecosystem Rankings to compare how various prefectures composing the country are striving to be more favorable environment to the thriving of business. The rankings framework are based on data provided by Centre des Formalités des Entreprises (the state-run agency for company registration). The data cover the first half (January to June) of the current year. The objective of the framework is to help founders, operators, and investors identify locations that could be beneficial to expand or invest in to generate outlier returns in the long run and help communes and their mayors in making informed development decisions.

The rankings revealed that:

Golfe Prefecture is by far the prefecture housing most of the newly created companies

AGOE NYIVE Prefecture is first runner-up

Zio Prefecture is third prefecture with largest number of newly created companies.

Introduction

The Togolese government has embarked for several years now on a charming campaign to attract investors regionally and globally to prop up its economic development plan. The ambitious plan dubbed Programme National de Devéloppement (PND) envisions to turn the West African country into a prominent regional economic hub alongside Nigeria, Cote d’Ivoire, Ghana and Senegal.

Despite the devastating impact of the pandemic and rising cost of living, it is impressive the trend of birth of companies as shown by Centre des Formalités des Entreprises.

The data provided by the agency enable a clear reading and understanding of the distribution of the newly created enterprises nationwide.

A snapshot of the distribution and rankings provide clear indications of areas or prefectures of the country where investment is being made or businesses are mushrooming. The rankings will help investors spend their money with less stress when making the decision to invest in Togo. Equally the purpose of the framework, the first, is to compare how the prefectures rank in overall development in their growth rates in relation to one another. It also seeks to help policy makers to make informed decisions so that the prefectures become more competitive.

AGBLECOM PARTNERS Prefecture Ecosystem Ranking

The rankings are based on data provided by Centre des Formalités des Entreprises. The data is an aggregate of the first six months of the year 2023 and represent the number of companies registered per prefecture during the six-month period.

The data does not provide details on the type of company created. The rankings do not provide reasons for the choice of the prefecture by investors. The rankings do not provide the identity or nationalities of the investors either.

Key findings

Golf Prefecture is most attractive prefecture for business establishment in Togo

Located in the Maritime region, the prefecture statistically during the first half of the year saw the creation of 4 701 businesses.

An average of 783 businesses are birthed every month during the six-month period. The area which includes the port of Lome, the city’s international airport and majority of hotels is undoubtedly the powerhouse of the country’s economy.

Agoe Nyive Prefecture comes second as ecosystem

Also located in the maritime region, the prefecture according to data provided by the “Centre des Formalités des Entreprises”, was the headquarters of 1,446 businesses during the first half of 2023.

The prefecture has recently seen an increase in its population. In addition, per last population census carried out this year, the prefecture is home to the largest population concentration of the country with nearly 2.2 million people out of 8.09 million that the entire country counts.

Zio Prefecture emerges as the third most attractive ecosystem

Adjacent to Golfe Prefecture, Zio prefecture during the first half of 2023, welcomed the creation of a total of 400 businesses.

| Prefectures | JanUARY | February | March | April | May | June | Total |

|---|---|---|---|---|---|---|---|

| Adeta | 7 | 9 | 7 | 4 | 3 | 5 | 35 |

| Agoe-nyive | 311 | 249 | 301 | 164 | 218 | 203 | 1446 |

| Agou | 3 | 0 | 1 | 3 | 1 | 1 | 9 |

| Amou | 2 | 0 | 2 | 1 | 1 | 0 | 6 |

| Anié | 3 | 4 | 2 | 0 | 1 | 4 | 14 |

| Assoli | 1 | 2 | 3 | 2 | 1 | 1 | 10 |

| Ave | 5 | 6 | 15 | 4 | 5 | 17 | 52 |

| Bassar | 2 | 4 | 1 | 2 | 1 | 10 | |

| Binnah | 1 | 1 | 1 | 2 | 0 | 2 | 7 |

| Blitta | 6 | 0 | 0 | 0 | 3 | 6 | 15 |

| Cinkassé | 6 | 9 | 9 | 7 | 4 | 1 | 36 |

| Dankpen | 5 | 2 | 3 | 0 | 1 | 1 | 12 |

| Doufelgou | 2 | 0 | 2 | 2 | 0 | 1 | 7 |

| Est-mono | 3 | 2 | 1 | 0 | 1 | 0 | 7 |

| Golfe | 918 | 841 | 876 | 639 | 703 | 724 | 4701 |

| Haho | 5 | 4 | 4 | 4 | 3 | 3 | 23 |

| Keran | 1 | 1 | 0 | 0 | 0 | 1 | 3 |

| Klotto | 8 | 7 | 9 | 8 | 8 | 6 | 46 |

| Koza | 30 | 34 | 27 | 15 | 22 | 35 | 163 |

| Kpendjal | 1 | 0 | 0 | 0 | 1 | 1 | 3 |

| Lacs | 31 | 27 | 28 | 14 | 13 | 27 | 140 |

| Mô | 1 | 1 | 0 | 0 | 0 | 0 | 2 |

| Ogou | 9 | 7 | 10 | 1 | 4 | 7 | 38 |

| Oti | 2 | 1 | 2 | 0 | 3 | 5 | 13 |

| Sotouboua | 8 | 4 | 0 | 2 | 3 | 2 | 19 |

| Tchamba | 6 | 1 | 2 | 2 | 2 | 5 | 18 |

| Tchaoudjo | 13 | 16 | 12 | 9 | 8 | 9 | 67 |

| Tone | 19 | 10 | 13 | 8 | 8 | 15 | 73 |

| Vo | 4 | 8 | 9 | 5 | 9 | 9 | 44 |

| Yoto | 1 | 2 | 10 | 3 | 8 | 3 | 27 |

| Zio | 77 | 57 | 65 | 51 | 72 | 78 | 400 |

| Wawa | 0 | 1 | 3 | 0 | 0 | 1 | 5 |

| Tandjouare | 0 | 1 | 0 | 0 | 0 | 0 | 1 |

| Bas-mono | 0 | 0 | 0 | 3 | 2 | 5 | |

| Afagnan | 0 | 0 | 0 | 1 | 0 | 1 | |

| Moyen-mono | 0 | 1 | 0 | 1 | 0 | 2 | |

| Danyi | 0 | 0 | 1 | 0 | 0 | 1 | |

| Akebou | 0 | 1 | 0 | 0 | 0 | 0 | 1 |

SOURCE: CFE / AGBLECOM PARTNERS, H1 2023.

Some factors to consider

Many factors can explain why some prefectures are more attractive than others in terms of business ecosystem.

The factors include culture of entrepreneurship, adoption of technology, presence of trained human capital and skills. Other factors include diplomatic representations, networks, banks, financial institutions, airport, port, hotels, events and relatively modern infrastructure.

COPYRIGHT © 2023 by AGBLECOM PARTNERS, Inc. All rights reserved. No part of this publication may be reproduced in any form or by any means—graphic, electronic, or mechanical, including photocopying, recording, taping, and information storage and retrieval systems—without the express written permission of AGBLECOM PARTNERS. Contents are based on information from a source believed to be reliable, but accuracy and completeness cannot be guaranteed. Nothing herein should be construed as investment advice, a past, current or future recommendation to buy or sell any security or an offer to sell, or a solicitation of an offer to buy any security. This material does not purport to contain all of the information that a prospective investor may wish to consider and is not to be relied upon as such or used in substitution for the exercise of independent judgment.